- Navigate – to https://rgtaxresolution.com/

- Find and click on the blue-colored CLIENT LOGIN tab located at the top middle of the webpage

- Logging-In – The first time you attempt to log in you will be asked to set up an account. Your portal directly relates to your RG Tax Accounting & Resolution account(s). The information needed to set-up your portal is your email address, this MUST be the email address you have on file with RG Tax Accounting & Resolution and your social security number or Employee Identification Number (EIN)).

- Password – By default, your password is the first four letters of your LAST name and the last five digits of your social security or EIN number.

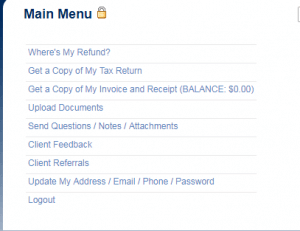

- After Successful Log-in you will see the Main Menu as shown below

**Please see the note below for important information on social security and EI numbers.

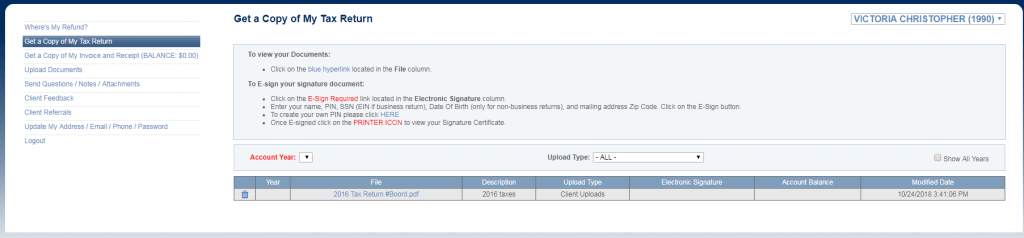

Select “Get a Copy of My Tax Return”. The page below will appear. Once you have selected the file or files you need you will then be able to view or print.

**If you are creating an account for your business or corporation and you file those taxes with an EIN, that is the number you will use to set-up that account. If you file individually, YOU MUST use your social security number. VERY IMPORTANT: If you are married and file jointly, YOU MUST use the primary tax payer’s social security number. This is the first name listed when filing your taxes. If you are unsure which taxpayer is listed as the primary, please contact the office.